Overall, the S&P 500 is having a very good year with a 4.36% gain in January.

According to this article on Seeking Alpha, this makes Jaunary 2012 the eleventh best performing first month of the year since 1957 (when the S&P took on its current form). With that being said, in this post we are going to discuss one of the stocks that has bucked that trend, RadioShack (ticker: RSH). About 1/3 of S&P stocks are in the red so far this year and RSH has the dubious honor of having had the biggest decline at -26%. Here's the top 10:

The bulk of this year's decline is

due to an earnings preview that was released on Tuesday where RSH warned that calendar 2011 Q4 earnings were going to come in lower than expected. Electronics retailers have bet big on wireless hardware and services but the trend is now for consumers to deal directly with service providers like Verizon and AT&T. Outside of just wireless, electronics retailers are suffering from "showroom syndrome" where consumers research their products at brick and mortar locations but end up making the actual purchase online.

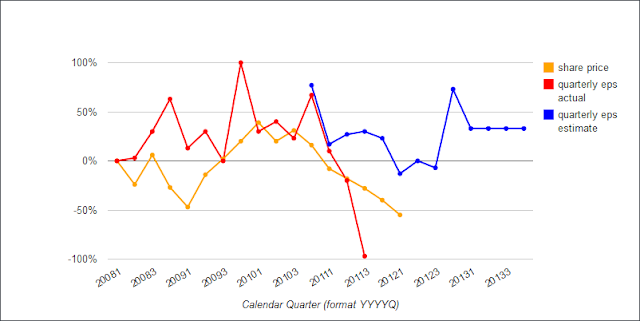

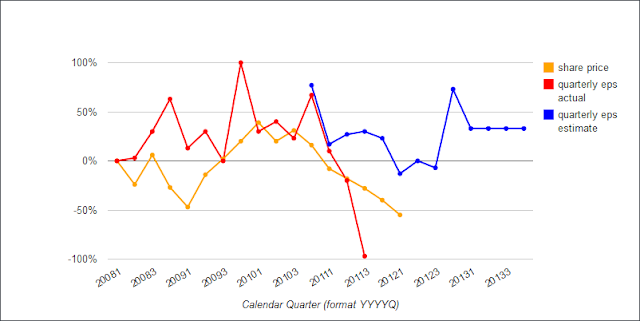

Here's a chart comparison of actual earnings, estimated earnings and share price:

RSH missed earnings badly in (calendar) quarters 2011 Q2 and Q3 which understandably caused the stock price to drop. The stock decline has continued after the negative preview on Tuesday. It is a particularly bad omen for a retailer to have calendar Q4 earnings to be projected lower than Q3 earnings.

No comments:

Post a Comment