From the New York Times:

While the agreement for as much as 60 billion euros ($86 billion), would in theory address Greece’s need for cash this year and next, it puts off for the time being a restructuring, hard or soft, of Greece’s huge debt burden

At the deal’s heart would be an informal understanding that the private sector holders of Greek government bonds might be persuaded to roll over their debts, or extend new loans when their older obligations come due.

The voluntary roll-over clause is a new twist that I hadn't heard of before. How exactly is that going to be enforced? Any deal who's "heart" consists of an unenforceable "persuasion" is not worth the paper it's written on, if in fact there was anything put in writing. It very well could be that the entire arrangement was communicated through winks and nudges.

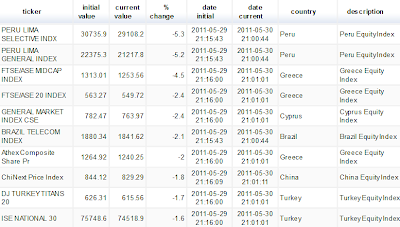

The immediate reaction in the stock markets around the world, and specifically Greece and Cyprus, was resoundingly positive. Greece's main index was up 6.8% and Cyprus, which lately has been joined to Greece's hip, was up 7.1%.

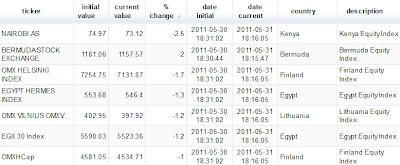

(Click on the image for a larger view. Click here for an updated listing of global equity indexes.)

The news that the world has been saved is taking a bit longer to reach the investors in some countries: